Bitcoin is the first and most popular cryptocurrency, with a market cap of over $600 billion as of May 2023. It is a decentralized network that allows users to send and receive value without intermediaries, using a public ledger called the blockchain.

However, Bitcoin also has some limitations, such as low scalability, high transaction fees, and limited functionality. These limitations have motivated some developers and innovators to create new solutions and applications on top of Bitcoin, using various technologies and protocols.

One of these technologies is BRC-20, which stands for Bitcoin Request for Comment.

BRC-20 is a token standard that enables users to create and issue tokens on the Bitcoin blockchain, similar to how ERC-20 tokens work on Ethereum.

BRC-20 tokens can represent various types of assets, such as currencies, commodities, stocks, or even non-fungible tokens (NFTs), which are unique digital collectibles. BRC-20 tokens are powered by Ordinals, which is a layer-2 protocol that aims to scale and enhance Bitcoin by allowing users to create and trade inscriptions, which are small pieces of data embedded in Bitcoin transactions.

Recently, BRC-20 tokens and Ordinals have been in the spotlight, as they have caused a surge in transaction fees and network congestion on the Bitcoin blockchain.

This has led to Binance, the largest crypto exchange, to temporarily halt bitcoin withdrawals, affecting the confidence and sentiment of crypto investors and traders. This event has also raised questions about the viability and security of these technologies, and how they impact the Bitcoin ecosystem.

In this article, we will explore the concepts and features of BRC-20 tokens and the Ordinals protocol, and how those tokens are affecting Bitcoin.

What just happened with bitcoin?

Bitcoin is known for its volatility, but the past week has been particularly turbulent for the leading cryptocurrency.

Bitcoin’s price dropped by more than 20% in a matter of days, reaching a low of $27,000 on May 8, 2023.

This was the lowest level since January 2023, and far below the all-time high of $69,000 that was reached in April 2023.

One of the main reasons behind this sharp decline was the surge in transaction fees and network congestion on the Bitcoin blockchain.

According to data from Bitinfocharts, the average transaction fee on Bitcoin reached $62 on May 7, 2023, the highest level since April 2021. The median transaction fee also spiked to $26, indicating that users had to pay more to get their transactions confirmed faster.

The cause of this increase in fees and congestion was the growing popularity of BRC-20 tokens, which are an experimental token standard for creating and issuing tokens and NFTs on Bitcoin.

BRC-20 tokens are powered by Ordinals, which is a layer-2 protocol that allows users to create and trade inscriptions, which are small pieces of data embedded in Bitcoin transactions.

BRC-20 tokens have attracted a lot of attention and demand from users who want to create and trade various types of assets on Bitcoin, such as currencies, commodities, stocks, or even non-fungible tokens (NFTs), which are unique digital collectibles. BRC-20 tokens are inspired by Ethereum’s ERC-20 token standard, which has enabled a flourishing ecosystem of decentralized applications (dApps) and decentralized finance (DeFi) on Ethereum.

However, BRC-20 tokens also have some drawbacks and limitations. One of them is that they consume a lot of block space on the Bitcoin blockchain, as each token transaction requires an inscription. This means that more users are competing for the limited space available in each block, which can only accommodate around 2,000 transactions on average. As a result, users have to pay higher fees to incentivize miners to include their transactions in the next block.

Another drawback is that BRC-20 tokens rely on token bridges and wrapped BTC to interact with other blockchains and platforms. Token bridges are smart contracts that allow users to move their tokens across different networks, while wrapped BTC are tokens that represent bitcoin on other blockchains. However, these solutions introduce additional risks and complexities for users, such as trusting third parties to custody their funds or facing potential exploits or hacks.

The impact of BRC-20 tokens and Ordinals on the Bitcoin network became evident on May 7, 2023, when Binance, the largest crypto exchange by volume, announced that it had temporarily halted bitcoin withdrawals due to network congestion. This caused a lot of panic and frustration among users who were unable to access their funds or move them to other platforms. Binance later resumed bitcoin withdrawals after a few hours, but the damage was already done.

The halt of bitcoin withdrawals by Binance affected the confidence and sentiment of crypto investors and traders, who saw it as a sign of instability and uncertainty in the market. This triggered a market-wide sell-off, as users rushed to liquidate their positions or hedge their risks. The sell-off was also fueled by other factors, such as regulatory crackdowns by China and other countries, Elon Musk’s tweets, and financial meltdowns at Bitcoin, Celsius, and Terraform Labs. These events created a negative feedback loop that drove bitcoin’s price down further.

What are the most prominent BRC-20 tokens?

ORDI

One of the most prominent BRC-20 tokens is ORDI, which stands for Ordinals Request for Comment. ORDI was the first BRC-20 token ever created, and it serves as a governance token for the Ordinals protocol. ORDI holders can vote on proposals and parameters that affect the Ordinals ecosystem, such as fees, rewards, and upgrades. ORDI also has a limited supply of 21 million tokens, mirroring Bitcoin’s scarcity.

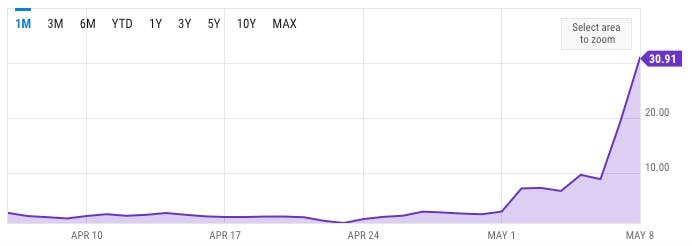

ORDI has attracted a lot of attention and speculation from users who want to participate in the Ordinals space and benefit from its potential growth. ORDI’s price has skyrocketed from less than $1 in March 2023 to over $18 in May 2023, reaching a market cap of over $400 million. ORDI has also been listed on major crypto exchanges, such as Crypto.com and Gate.io, increasing its liquidity and accessibility.

PEPE

Another popular BRC-20 token is PEPE, which is inspired by the famous internet meme of a frog with various expressions. PEPE is a fun and playful token that allows users to create and trade NFTs based on Pepe images on Bitcoin. PEPE also has a limited supply of 21 million tokens, and its price has surged from less than $1 in April 2023 to over $10 in May 2023, reaching a market cap of over $200 million.

MEME, PIZA & DOMO

Other notable BRC-20 tokens include MEME, which is a token for creating and trading NFTs based on memes on Bitcoin; PIZA, which is a token for ordering pizza with bitcoin; and DOMO, which is a token named after the creator of BRC-20 and Ordinals.

These BRC-20 tokens have caused a lot of activity and congestion on the Bitcoin network, as users mint and transfer them using inscriptions. Each inscription requires a small amount of bitcoin to be spent as a fee, which adds up to a large amount of block space being consumed by BRC-20 transactions. This has led to higher fees and longer wait times for other bitcoin transactions, as well as temporary halts in bitcoin withdrawals by some exchanges.

The Bitcoin dilemma

Bitcoin has long been viewed as the king of cryptocurrencies, but as we just saw, its recent struggles with high transaction fees and the proliferation of non-fungible tokens (NFTs) and other tokens have called into question its future as a digital asset. The average transaction fees for Bitcoin are notoriously high and are only getting worse due to the increased printing of tokens and NFTs on the Bitcoin network.

One of the main challenges facing Bitcoin is a fundamental dilemma: it cannot be both a digital gold and a smart contract platform. Some have attempted to build on Bitcoin’s programmable features by creating new tokens, but these tokens are not always easy to buy, transfer, or use in a way that makes them truly fungible.

The current payment model for miners in Bitcoin is based on market demand and transaction fees, rather than inflation. While this model has helped to keep miners paid, it also exacerbates the problem of high transaction fees and the difficulty of performing many transactions at a time.

The overall cryptocurrency market is currently in a sideways trend, with Bitcoin down 2.4%, Ethereum down 1.4%, and other altcoins also down. This trend is likely to continue for some time, and it remains to be seen whether the mid-cycle pump is over.

What’s next for Bitcoin?

The problem of NFTs and tokens on the Bitcoin network is largely a result of a recent upgrade, and it has raised important questions about what Bitcoin wants to be and how it can adapt to the changing needs of the cryptocurrency ecosystem. Some have suggested increasing blocks to solve the problem of low miner earnings and high transaction fees, but there is significant debate about whether this is the right solution.

Alternatively, working on innovation for Layer Two solutions, such as Anchor and Settle Layer Twos through zero knowledge, could be a more promising approach. This would allow Bitcoin to attract more projects from Ethereum and traders if an EVM is anchored to bitcoin.

One significant risk facing Bitcoin is the potential for devs to remove its Original Inscriptions at any time, which could leave projects built with them vulnerable to being nuked. The community needs to decide on a clear direction for Bitcoin’s future to avoid being stuck in limbo.

Overall, the challenges facing Bitcoin are significant, but there are also many opportunities for innovation and growth. By addressing these challenges head-on and working collaboratively, the Bitcoin community can help to ensure that it remains a vital and relevant player in the world of cryptocurrencies for years to come.

This article was originally published by stephabauva on Hackernoon.