Los Angeles has long been renowned for the prowess of its entertainment industry, with Hollywood being a larger-than-life symbol known across the world. Yet the growth of its tech sector has also increasingly been receiving attention.

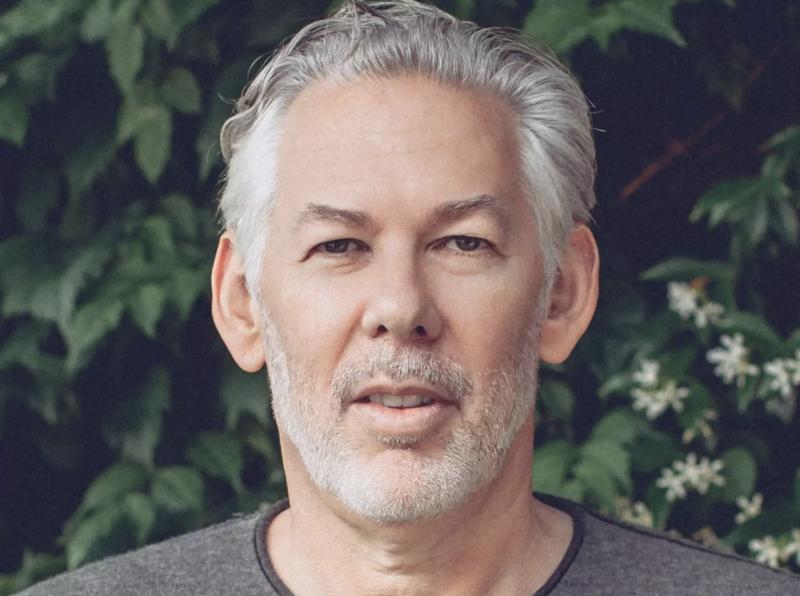

Below is an interview with Brad Zions from Los Angeles to get a better perspective on tech trends in the region.

Could you tell us a little about the tech scene in Los Angeles?

Los Angeles (LA) is now the third-largest startup market in the U.S. with nearly 4,000 venture-backed startups based here. L.A. comes in behind mega hubs in the San Francisco Bay Area and New York and ahead of other emerging tech hubs like Miami and Houston, highlighting its importance within the US startup scene.

Known as “Silicon Beach” due to its proximity to surf and sand, I’d say the tech community’s attraction to the area can be partly credited to its proximity to LAX and the diversity of LA’s industries. This mash-up between the old glamour of Hollywood and innovation from the Bay Area has already given rise to prominent startups.

Why is Los Angeles a good place for startups?

In many cases, Los Angeles offers founders a really strong network of private investors. There’s also a large culture of entrepreneurship with accelerators and local events going on that help founders at all stages to make solid connections with potential partners and rising talent.

The city has long been known as a hotbed for aspiring movie stars and scriptwriters, but now founders and tech experts can tap into a similar network. For example Fusion LA, a Santa Monica early-stage accelerator that provides nascent software startups from Israel’s booming tech scene an entree into the U.S. market, is upping its initial investment to $110,000. That’s up from the $20,000 checks it has written since the program started in 2017.

Could you tell us more about your history in the tech industry?

One of my earliest ventures with tech and the internet was with America Online. I worked there from 1994 and helped to launch AOL in Europe, which allowed me to spend some exciting years working abroad.

In 2009 I partnered with chef Alan Jackson to co-found the Lemonade Restaurant Group, helping to grow the fast casual concept to over 10 locations in my role as Chief Financial Officer.

In addition, I worked as an early-stage investor both as a partner at Structure Fund and as an angel and went on to found Pitbull Ventures in 2021 where I focus on pre-seed opportunities in vertical SaaS.

Notable exits in my portfolio include Podsights, Venga, and Jukin Media. Other notable names within the portfolio include VidMob, Harri, Embrace, and Parachute Home.

Could you give us more details on any specific ventures from your portfolio?

GroWrk is a smart IT asset management platform that addresses a niche in IT that is growing alongside the rise of distributed teams in recent years, making IT logistics more tricky and time-consuming to manage.

The platform helps to reliably deploy and manage global teams’ IT assets, control all equipment processes and track procurement and delivery through an intuitive dashboard. This was all sparked when the founders of GroWrk experienced significant challenges equipping team members abroad in previous organizations.

This gave them both the idea and the insight needed to create a really neat, targeted SaaS solution for this workflow.

Could you share any more details on Pitbull Ventures and what you look for?

Pitbull Ventures is based in Los Angeles, and we back exceptional founders across the US. We’re a pre-seed vertical SaaS fund and have already invested in over 40 startups.

Really for us, it comes down to founders who have deep domain expertise in a particular vertical and who have signs of early product market fit. I’m bullish on the sector because, although investor activity is quieter than in the past, the slower, more cautious pace means that the strongest founders and their new products have more space to rise to the surface.

There’s also more tech talent in the job market, along with new AI tools that make it easier to build an MVP with a bootstrapped software team. In short, 2024 is actually one of the best times for founders to launch a startup.